Car title loans provide a unique, collateral-based financing option for individuals with poor credit or no history. Understanding interest rates, repayment plans, and repossession risks is crucial for informed borrowing decisions. Car title loan financial literacy empowers people to manage unexpected expenses, break free from debt cycles, and reduce reliance on fast cash options by strategically planning loan payoffs and building emergency funds.

Car title loans, often overlooked, offer a unique financial tool for those in need of quick cash. This article explores how enhancing financial literacy surrounding car title loans can empower borrowers to make informed decisions, ultimately reducing reliance on emergency loans and fostering long-term financial stability. By understanding the intricacies of these loans, individuals can navigate this option with confidence, leading to better borrowing habits and improved economic well-being.

- Understanding Car Title Loans: A Financial Tool

- Building Literacy: Empowering Borrowing Decisions

- Reducing Dependency: Long-term Financial Health

Understanding Car Title Loans: A Financial Tool

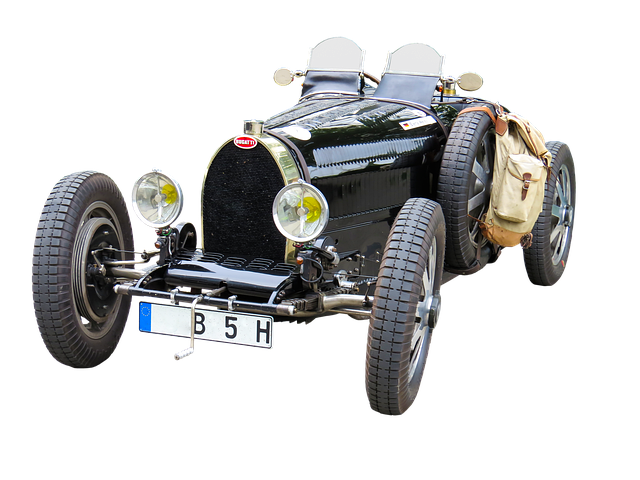

Car title loans are a type of secured lending that uses a vehicle’s ownership as collateral. This financial tool allows borrowers to access cash by pledging their car title, providing a quick and convenient solution for emergency funding needs. Unlike traditional loans that rely on credit scores, car title loans assess the value of the vehicle, making them accessible to individuals with less-than-perfect credit or no credit history.

Understanding how car title loans work is crucial in enhancing financial literacy. The process typically involves borrowing a specific amount, agreeing to a set interest rate, and establishing a repayment plan. Borrowers retain vehicle ownership but must ensure timely payments to avoid repossession. This alternative financing option can empower individuals to manage unexpected expenses while potentially reducing their long-term debt burden and dependency on emergency loans.

Building Literacy: Empowering Borrowing Decisions

Financial literacy is a powerful tool that can transform an individual’s relationship with borrowing and lending. When it comes to car title loans, understanding the fundamentals empowers borrowers to make informed decisions. This process begins by recognizing the value of flexible payments, which allows individuals to manage their loans according to their financial flow. Car title loan financial literacy ensures borrowers grasp how quick approval processes work, enabling them to access funds swiftly during emergencies.

Moreover, it educates borrowers about various repayment options and strategies, encouraging responsible borrowing. By learning about these aspects, individuals can strategize for the loan payoff, ensuring they meet their obligations without falling into a cycle of debt. Ultimately, this knowledge equips people to navigate financial challenges with confidence, utilizing car title loans as a temporary bridge rather than a long-term burden.

Reducing Dependency: Long-term Financial Health

Car title loan financial literacy isn’t just about accessing fast cash; it’s a key strategy for reducing dependency on emergency loans in the long term. By understanding the nature of Car Title Loans and their impact on personal finances, individuals can make more informed decisions. This proactive approach ensures that what starts as a temporary solution to cover urgent expenses doesn’t escalate into a cycle of debt.

Gaining financial literacy involves recognizing that while Car Title Loans offer immediate relief, they come with specific terms and conditions. Educated borrowers appreciate the importance of timely repayment to avoid significant interest charges. They also understand that building an emergency fund is a fundamental aspect of financial health, reducing the need for frequent reliance on alternative financing methods, including fast cash options that often require extensive credit checks.

By enhancing their understanding of car title loans and building financial literacy, individuals can make informed borrowing decisions. This empowers them to access much-needed funds during emergencies without falling into a cycle of dependency on short-term loans. With the right knowledge, car title loans can serve as a tool for achieving long-term financial health and stability.